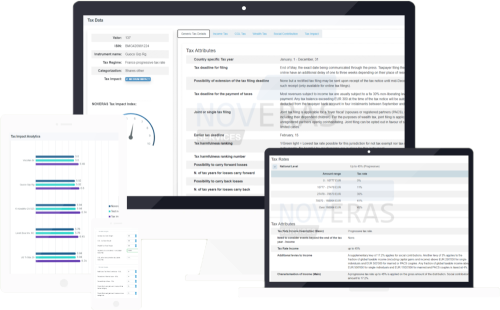

Reduce the complexity of taxation rules with Noveras Tax Impact Index (NTI)

We do realize that even with our Tax On Instrument data enrichment the tax implications of a financial instruments are still very complex, so we have developed a special indicator reducing this complexity into a single number representing tax impact on instrument.